The Definitive Guide to Kam Financial & Realty, Inc.

The Definitive Guide to Kam Financial & Realty, Inc.

Blog Article

The Main Principles Of Kam Financial & Realty, Inc.

Table of ContentsGetting The Kam Financial & Realty, Inc. To WorkThe 20-Second Trick For Kam Financial & Realty, Inc.Our Kam Financial & Realty, Inc. IdeasThe Ultimate Guide To Kam Financial & Realty, Inc.The Single Strategy To Use For Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. Can Be Fun For Anyone

We might get a cost if you click on a lending institution or send a form on our website. The lenders whose rates and various other terms appear on this chart are ICBs promoting partners they supply their price info to our information companion RateUpdatecom Unless changed by the customer marketers are arranged by APR lowest to highest For any advertising partners that do not provide their rate they are noted in advertisement display systems at the bottom of the chart Advertising partners may not pay to improve the frequency top priority or prestige of their display screen The passion prices annual portion rates and other terms marketed below are estimates given by those marketing companions based on the information you entered above and do not bind any lending institution Month-to-month repayment amounts specified do not include amounts for taxes and insurance costs The actual payment commitment will certainly be greater if tax obligations and insurance coverage are included Although our information partner RateUpdatecom collects the details from the monetary institutions themselves the precision of the data can not be assured Rates might alter without notice and can change intraday Some of the details included in the price tables including but not restricted to special advertising and marketing notes is offered straight by the loan providers Please validate the rates and deals before using for a finance with the financial establishment themselves No rate is binding till locked by a loan provider.

Unknown Facts About Kam Financial & Realty, Inc.

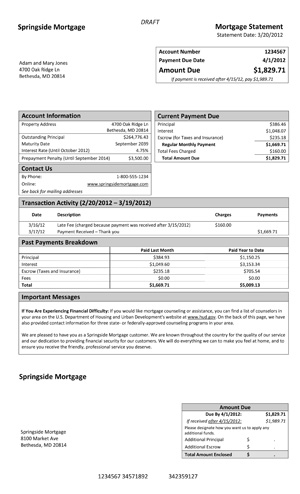

The quantity of equity you can access with a reverse home mortgage is established by the age of the youngest consumer, existing rates of interest, and the worth of the home in concern. Please note that you may need to establish apart added funds from the finance continues to pay for taxes and insurance.

Rates of interest may differ and the stated rate may transform or not be available at the time of lending dedication. * The funds offered to the borrower might be restricted for the initial year after lending closing, as a result of HECM reverse home loan requirements (https://medium.com/@luperector/about). Additionally, the consumer might need to establish aside additional funds from the loan continues to pay for tax obligations and insurance policy

A home mortgage is essentially a financial arrangement that enables a borrower to acquire a residential property by getting funds from a lender, such as a financial institution or banks. In return, the loan provider places an actual estate lien on the residential property as safety and security for the loan. The home loan transaction commonly includes 2 main records: a promissory note and an act of count on.

Examine This Report on Kam Financial & Realty, Inc.

A lien is a lawful claim or rate of interest that a lending institution carries a borrower's building as security for a debt. In the context of a home loan, the lien produced by the action of trust fund permits the lending institution to seize the home and offer it if the customer defaults on the funding.

Listed below, we will take a look at a few of the common types of home loans. These home loans feature an established interest rate and monthly settlement quantity, view it using stability and predictability for the customer. John makes a decision to purchase a house that sets you back $300,000 (mortgage lenders in california). He protects a 30-year fixed-rate mortgage with a 4% rate of interest.

The 3-Minute Rule for Kam Financial & Realty, Inc.

This suggests that for the entire three decades, John will make the exact same month-to-month repayment, which offers him predictability and stability in his economic planning. These mortgages begin with a set rate of interest rate and repayment quantity for an initial period, after which the passion rate and settlements may be occasionally adjusted based upon market problems.

Some Known Questions About Kam Financial & Realty, Inc..

These mortgages have a set rate of interest and repayment quantity for the loan's period yet call for the consumer to pay back the loan balance after a specified period, as established by the lender. mortgage lenders california. For example, Tom has an interest in acquiring a $200,000 home. https://zenwriting.net/kamfnnclr1ty/why-partnering-with-a-mortgage-loan-officer-in-california-makes-sense. He selects a 7-year balloon home loan with a 3.75% fixed rate of interest

For the whole 7-year term, Tom's month-to-month repayments will certainly be based on this fixed rates of interest. After 7 years, the continuing to be lending equilibrium will certainly come to be due. Then, Tom should either pay off the exceptional balance in a swelling sum, re-finance the car loan, or market the property to cover the balloon payment.

Wrongly claiming to survive on a residential or commercial property that will certainly be utilized as an investment residential property in order to safeguard a lower rate of interest. Appraisal fraud includes intentionally misestimating or underestimating a home to either get even more cash or safeguard a lower cost on a confiscated building. Incorrectly asserting self-employment or an elevated position within a firm to misrepresent earnings for mortgage purposes.

Kam Financial & Realty, Inc. Fundamentals Explained

Report this page